Convert Life Insurance into Cash Payments to Help Pay for Long Term Care

The Benefit is specifically designed to address an immediate need to pay for long term care services. Qualifying is quick and uncomplicated.

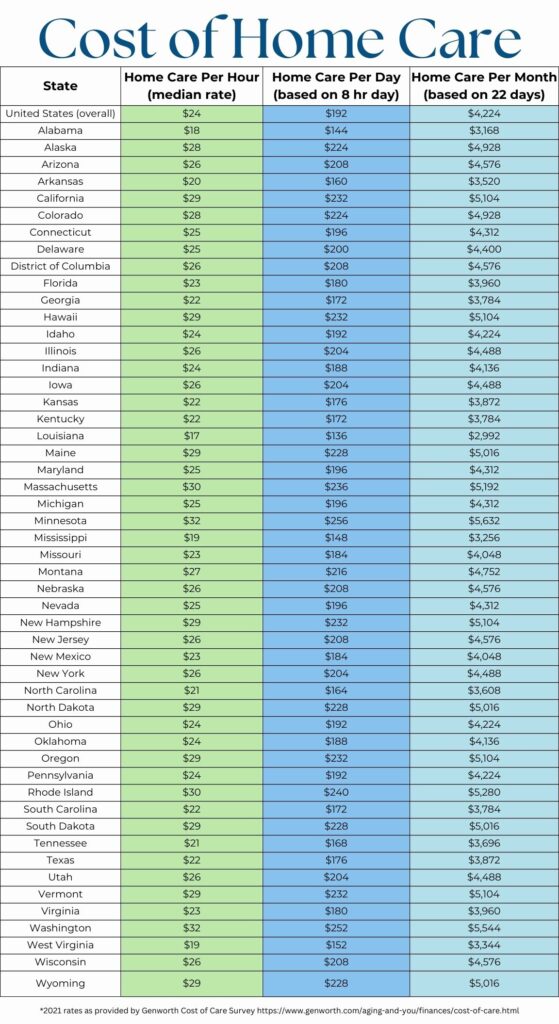

Paying for long term care is getting more difficult as the cost of care rises.

Converting a life insurance policy is a Medicaid qualified spend down of the policy and preserves a portion of the death benefit for the family. After years of premium payments, many policy owners will allow a policy to lapse or surrender it for any remaining cash value. This is a big mistake when the same policy could be converted to pay for the costs of long term care and still retain a funeral expense benefit.

Medicaid Life Settlement Overview

- Simple, no-cost application and review process

- Quick approval and funding (no wait periods)

- No age minimum

- No premium payments

- All types of in-force life insurance qualify

- Monthly payments made directly to care provider/facility

- Provides Funeral Expense benefit

Are there any fees to apply and do we have to keep paying premiums?

No, there are no fees or obligations to apply and no more premium payments due on the policy once converted to a Medicaid Life Settlement Plan.

Are funeral expenses covered?

Yes, a Medicaid Life Settlement Plan also provides a final expense benefit to the family.

What type of life insurance policies qualify for conversion?

All types of life insurance qualify as long as they are still in force. Universal Life, Whole Life, Survivor Life and even Group or Term Life Insurance may qualify. Even if your policy has absolutely zero in cash surrender value it may still qualify for monthly cash payments to pay for long term care.

What type of care will the Benefit cover?

You have a choice in your care and facility and are not limited to Medicaid approved assisted living facilities.

- Nursing Home

- Assisted Living

- Hospice Care

- In-Home Nursing/Health Care

Before you cancel your life insurance policy, please take the time to see if it may have value as a long term care benefit plan. The valuation costs nothing and you are under no obligation at any time. Do your Homework!