Sell Your Life Insurance Policy For Cash

Sell Your Life Insurance Policy

Can you really sell your life insurance policy for cash?

“Can you really sell your life insurance policy for cash?” is often the first question we are asked. “Is selling your life insurance policy a good idea?” and “How old do you have to be to sell your life insurance policy?” are close behind.

The short answer to each question is ‘ it really depends.’

Who buys life insurance policies?

Let’s start with Who buys life insurance policies? Life settlement providers typically purchase life settlements for life settlement investors or buy viatical and life settlements for their own life settlement portfolios.There are sometimes also life settlement brokers who broker the sale of life insurance policies involved in a transaction between life settlement providers and you if you are trying to sell your insurance policy.

Life settlement and viatical buyers often look at valuing your insurance policy from different angles and with different purchase parameters with respect to time and money. It is important to understand how your life insurance policy is valued before you just start calling a list of companies that buy life insurance policies.

How old do you have to be to sell your life insurance policy?

There are many variables that go into the valuation of a life insurance policy as a life settlement or viatical settlement. No two life settlement cases are the same. Your age, health, and the type and amount of your life insurance policy matter most. The average life expectancy for 65 year olds in the United States has increased slowly, but consistently, for more than 50 years and is currently at 18 years. If you want to know if you can sell your life insurance policy if you are under 65, consider that someone, the life settlement buyer, will likely be paying your premiums for 18 years or longer.

Regardless, there are life settlement buyers that will buy certain life insurance policies from reasonably healthy individuals, depending on the policy, down to around age 60. People are often shocked that they are able to sell the policy for as much or more than they paid into the life insurance policy over the years. Even term insurance and policies with no cash value may have a value in the secondary market for life insurance as a life settlement. No one over age 65 should cancel, surrender, or lapse a life insurance policy without first checking to see if it has value as a viatical of life insurance settlement.

Sell your term life insurance policy

It surprises some people that term life insurance policies and other policies with absolutely zero cash value may have value as a life settlement. Offers are usually confined to convertible term life insurance policies, but you can sell your term life insurance policy provided that you qualify from an age and health aspect.

It is not uncommon for someone who sells their term life insurance policy for cash to receive as much cash as they have paid into the term life insurance policy over the years. A typical 75 year old male will have paid $50,000 in insurance premiums over a 20 year period for a $1,000,000 term life insurance policy if his premium was $2500 per year.

It is not uncommon for that same 75 year old to receive as much, if not more, than he has paid into the policy over the years, depending upon his health and the particulars of the term life insurance policy he is trying to sell.

Hopefully you no longer need your life insurance policy and are not trying to sell your life insurance policy for cash to put food or medicine on the table, but often the hidden value in a life insurance policy is one of the largest assets that someone has. Sadly, over $200 billion in policyface value is lapsed or surrendered each year.1 These policies could have and should have been sold instead, allowing policy owner to recoup some (or all) of the funds invested in premium payments.

Though you do not have to be chronically ill or have a terminal diagnosis to have a hidden value in your life insurance policy, generally, the worse your health, the higher the value of your life insurance policy as a life settlement. Viatical settlements are the sale of insurance policies by people who have had the misfortune of being diagnosed as terminally ill, generally with a life expectancy of 2 years or less.

If you are terminally ill, your insurance policy may be worth much more than you realize and the proceeds of the sale of an insurance policy are generally tax free if someone is terminally ill. If you are not terminally ill or even if you are in sound health, generally anything you receive above and beyond your cost basis in the life insurance policy is taxable. Typically, any roll over monies or premiums you have paid into an insurance policy is your cost basis and anything above that amount is taxable. Tax treatment does vary by state and you should always check with your trusted tax advisor on matters of this nature before inadvertently creating negative tax consequences.

If you are trying to value your life insurance policy, there is no perfect “sell my life insurance policy calculator button” you can push to give you an exact value. To arrive at an exact value of your life insurance policy, your medical information and insurance policy information would have to be formally acquired and reviewed. Even then, no two life insurance policies are the same and depending upon your health and the type of life insurance policy you have, you only truly know what a life insurance policy is worth when you begin to get offers and bids. Before you start releasing all of your personal medical information and life insurance policy specifics to the masses, please take the time and do a little homework. Although you cannot obtain an exact value without a formal valuation, life settlement calculators can give you a general idea.

Do You Qualify?

Does your life insurance have hidden value?

Every case is different. Please fill out this form to learn if you qualify.

What Are Viatical Life Settlements?

Call for an appraisal before you attempt to sell your life insurance policy for cash.

Is selling your life insurance policy a good idea or not?

If one no longer needs insurance, has more insurance than they need, or would otherwise lapse a policy due to increasing premiums, selling an insurance policy can be an easy decision. Sometimes, individuals need or desire to maintain part of their life insurance. It is possible to sell a portion and retain a portion of your life insurance policy. If you are chronically ill, you may qualify for a life insurance loan or a life insurance advance. With a life insurance loan, you can usually borrow from your life insurance policy tax free and retain a portion of your life insurance policy for your loved ones.

The best place to start if you are looking at the life settlement market to sell your life insurance policy is by seeing if you qualify and determining if your life insurance policy has value as a life settlement. Please allow us to help you.

Call for an appraisal before you attempt to sell your life insurance policy for cash.

Best Company To Sell Your Life Insurance Policy To

The best company to sell your life insurance to is usually the company that pays you the most money. That’s provided that it’s an institutional fund or a company that buys life insurance policies and not Tony Soprano’s IRA. If selling your life insurance policy for the most cash in your pocket is your goal, be aware of life settlement broker commissions that are often 30% of the sale of your life insurance policy, but can be even more.

Companies that buy your life insurance do not require medical exams. To qualify for a life settlement, your policy has to be in force for at least two years, more in some states. To sell a term life insurance policy, your policy usually must be convertible.

Can I sell my life insurance policy direct?

Once you’ve decided to sell a life insurance policy and are looking for life insurance buyers or a company that buys life insurance policies, you should start by getting a life settlement appraisal. There are life settlement appraisal calculators all over the internet, but I’ve yet to find one that’s accurate that doesn’t give an enormous range of value.

When selling your life insurance policy, the two largest variables for companies that buy existing life insurance policies are your health and the specifics of your policy. Some companies that purchase life insurance policies will only purchase policies on people over age 65. Other companies, known as viatical buyers, will only purchase life insurance policies on people who unfortunately have a life expectancy of less than 24 months.

You shouldn’t just call the first ad you see and say I want to sell my life insurance policy. If you’re trying to sell term life insurance policies, some companies can’t buy them. If you’re under age 65, some companies can’t buy your policy. If you’re too healthy or too sick, some of the best companies that buy life insurance policies won’t even look at it. Many life settlement companies won’t buy term insurance policies and companies that buy term life insurance policies often have many restrictions.

Companies that buy life insurance policies

Companies that buy life insurance policies come in all shapes and sizes and with assorted ethics. The behind the scenes of selling your life insurance is as involved as selling a home and life insurance policy buyers are professionals.

Historically, life settlement brokers would gather your permanent life insurance and term life insurance policy information. Based on your death benefit and whether you’re healthy or had a terminal illness, they would shop it to buyers of life insurance policies.

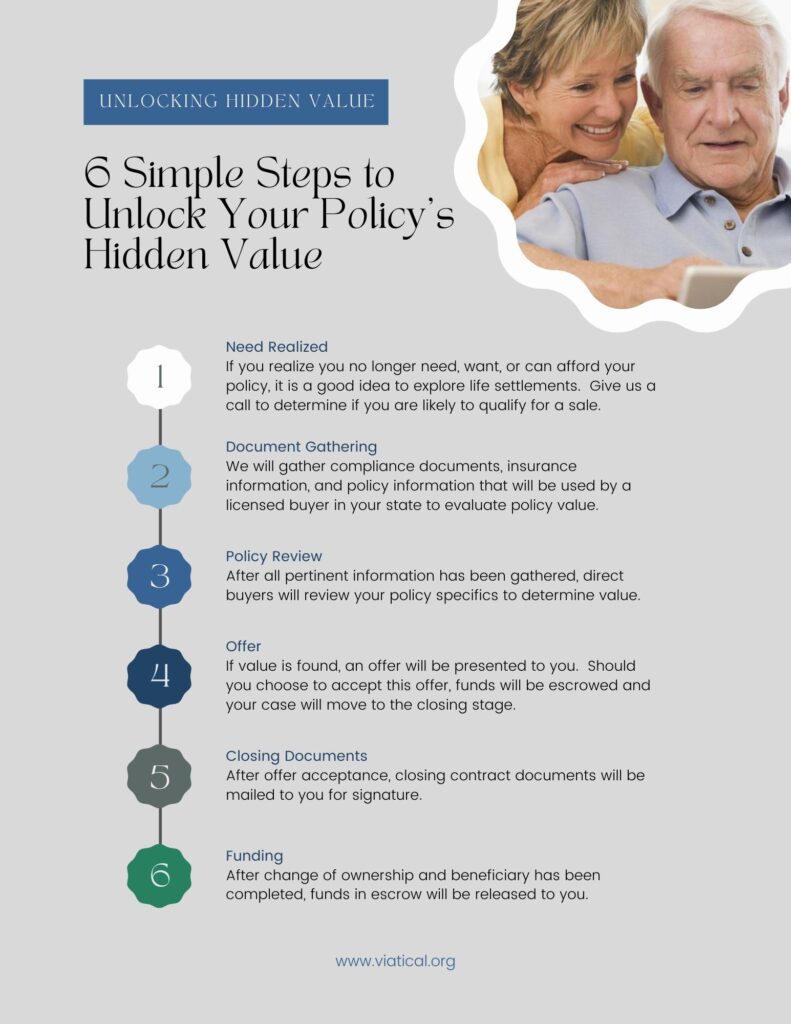

We presented the first direct platform many years ago and now you are able to take advantage of a network of direct buyers and an automated platform that gathers your insurance and medical information for licensed reputable buyers in your state.

Usually, the larger your death benefit, the more companies are willing to bid on your life insurance policy. There are life insurance policy buyers that will buy down to $100,000 of death benefit or even a $50,000 face amount if you’re terminally ill.

It’s important to get your life insurance policy in front of the right buyers. The first step is to get an appraisal and an explanation of what you have.

List of Companies That Buy Life Insurance Policies

The fact is there is not a list of companies that buy life insurance policies. There is a Life Insurance Settlement Association with members, but nearly all of the members are either life settlement brokers or life settlement providers who close transactions and usually do not buy for their own account.

Understanding the Landscape of Life Insurance Buyers

There are many institutional life settlement funds. Many life settlement companies protect their buyers in the market. Various buyers of life insurance have different appetites for your life insurance policy based upon the face amount, your health, and the quality of your life insurance company.

It is always best to get more than one bid on your life insurance policy. Just because someone turns down your policy doesn’t mean that there isn’t someone else out there that might see value in it. Buyers of life insurance policies all have a slightly different way of looking at things.

Viatical.org will help you understand what you have and get a potential range of value on the front end with no fee or no obligation. There’s absolutely no better starting point.

Growing Network of Direct Buyers

The network of funds that purchase policies direct from consumers through viatical.org has grown over the past 15 years. There are buyers on our platform that will only purchase policies from those that are unfortunately terminally ill and there are buyers that will purchase policies on perfectly healthy people if they’re old enough and your life insurance policy has the right guaranteed provisions.

The Importance of Appraisals

Selling your life insurance policy for cash is a lot like selling your home. No two properties are the same and the value has to be in the eye of the beholder or in this case the buyer of your life insurance policy. Arm yourself with an appraisal so that you have some idea of where to start and you’ll have no difficulty in saving up to 30% broker fees on transaction by selling your life insurance policy direct.

Call our friendly, knowledgeable staff before attempting to sell your life insurance policy for cash.

The best place to start if you are looking at the life settlement market to sell your life insurance policy is by seeing if you qualify and determining if your life insurance policy has value as a life settlement. Please allow us to help you.

Footnotes

- McGonnell, Shane. “Why Life Settlements Are Becoming A Mainstream Financial Option.” Forbes.Forbes.com, 07May. 2020. Web. <Why Life Settlements Are Becoming A Mainstream Financial Option (forbes.com)>

The cash value of a life insurance policy is a feature typically associated with permanent life insurance policies, such as whole life or universal life insurance, rather than term life insurance. These policies accumulate cash value over time, allowing the policyholder to access funds while the policy is in force.

The specific amount of cash value in a $250,000 life insurance policy would depend on various factors, including the policy’s time in force, premium payments, policy type, interest rates, and any outstanding loans or withdrawals.

Your policy’s hidden value, which can be accessed through a life settlement or viatical settlement, is likely significantly higher than the cash surrender value. Even term life insurance with no cash value may have a hidden value.

If you find yourself in a financial bind, you may be wondering if you can sell your life insurance policy for cash. The answer is yes, you can sell your life insurance policy in exchange for a lump sum payment through a process known as a life settlement if you qualify.

Life insurance buyers, also known as life settlement companies, purchase life insurance policies from individuals in exchange for a cash payment. The amount of money you can receive from selling your policy will depend on a variety of factors, including your age, health, and the terms of your policy.

If you’re contemplating the sale of your life insurance policy, you might be curious about the potential value. The amount you can receive from selling your policy is influenced by several factors, such as your age, health status, and the policy’s terms and conditions.

If a life settlement fund finds value in your policy, they will present you with a lump sum cash offer. This offer will be based on factors like the face value of your policy, among others, and will consistently exceed the policy’s cash surrender value.