Knowledge is Power

Do you ever feel like you are worth more dead than alive? Your life insurance policy is no longer an all or nothing proposition.

It costs nothing and there is no obligation to see if you qualify to sell a portion of your life insurance for cash today.

A 5 minute call is all it takes to see if you are likely to qualify.

Viatical and Life Insurance Settlements Can Unlock Hidden Value

Dealing with the financial and emotional burdens of a cancer battle can be incredibly challenging. Your focus should be on receiving the best possible care, without worrying about the financial aspects. However, it’s important to be aware that your illness may have created a hidden value within your existing life insurance policy, which can serve as an emergency fund.

If you meet the qualifications, you have the option to convert this hidden value into cash by selling a portion of your life insurance policy. The cash you receive is often tax-free due to your condition. Even if you have a Term Life Insurance policy or a policy with zero cash value, it could still hold significant hidden value that can be utilized for medical bills, medications, replacing lost income, and other hidden costs associated with a cancer battle. In fact, the more severe the illness, the greater the hidden value you will typically have.

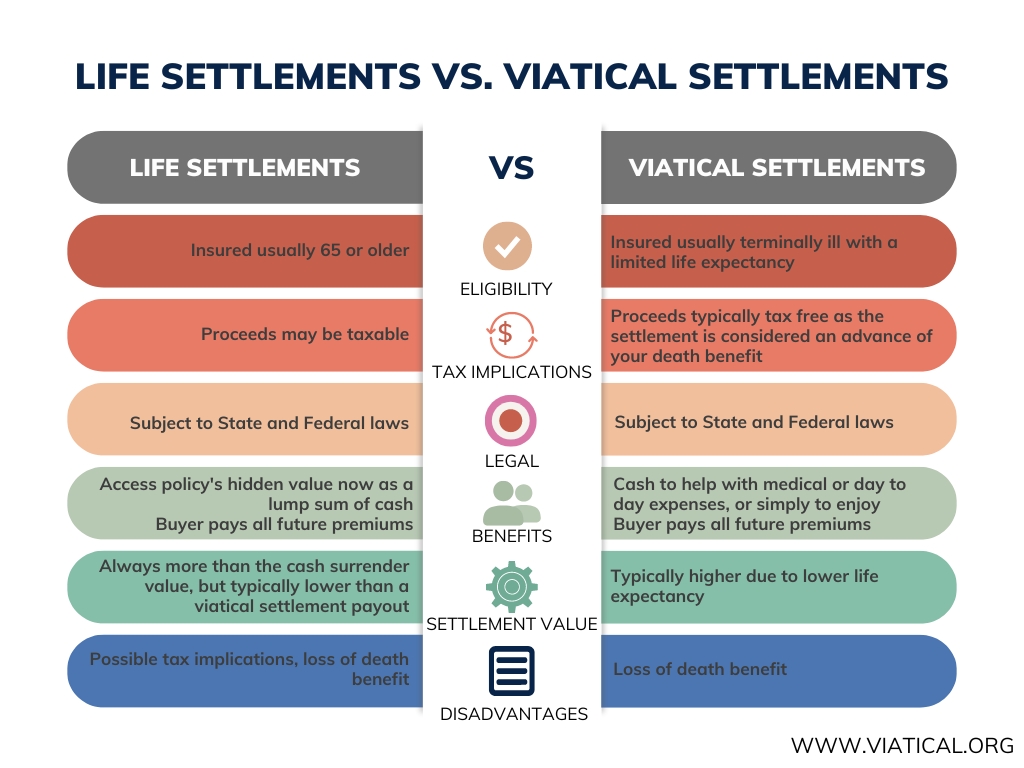

While there are some differences between viatical and life insurance settlements, both can help you unlock hidden value in your existing life insurance policy.

Gone are the days when life insurance was an all-or-nothing proposition. Now, you have the opportunity to benefit financially while you’re still alive by tapping into the true hidden value of your life insurance policy now, when you need it the most.

Qualifying for Viatical and Life Insurance Settlements

Determining if you are likely to qualify for a viatical settlement usually takes just a 5-minute phone call. A licensed buyer in your state can provide you with an appraisal based on your specific health and policy details.

There is never any fee or obligation to learn if you have a hidden and untapped emergency fund within your life insurance policy.

“I really didn’t have the extra money to pay for the therapy I felt was best for me. I tried to get a life insurance cash advance, but they (the insurance company) said I wasn’t sick enough. Viatical.org’s direct buyer gave me $95,000 for my $250,000 policy! I just finished my 13th treatment. I told them I would recommend them to anyone, so now I am!”

J.M.

Do you feel like you are worth more dead than alive?

Your Life Insurance Policy is no longer an all or nothing deal. If your health has slipped, you might qualify for a viatical settlement and the cash proceeds from the sale of your life insurance policy can be used for whatever you want.

John, a 47 yr old male with a terminal cancer diagnosis, a family to worry about and a life expectancy of only a few years contacted us. Once we gathered all of John’s medical information from his Doctors and his specific Life Insurance Policy information from his Insurance company, it was determined that John had value in his insurance policies, which he could access today.

John chose to sell one of his insurance policies for a lump sum cash settlement today. He was able to pay off his mounting bills and better position his finances to take care of his family.

Policy Type: Convertible Term Life Insurance

Policy Face Value: $1,250,000

Cash Surrender Value: $0

Hidden Value: $750,000 that could be used immediately

Life Settlement Companies: Navigating the Industry

Within the life settlements industry, there are various types of companies that specialize in creating viatical or life settlements out of existing insurance policies.

Buyers of life insurance policies and alternative investments are attracted to the non-correlated returns offered by life settlements. These investments are based on factors like life expectancy and actuarial tables, rather than being tied to the stock market or interest rates. The calculation involves assessing the insured’s life expectancy against the cost of paying the premiums on the policy.

It’s important to note that life settlement brokers and settlement investment buyers often prioritize their own interests. While the National Association of Insurance Commissioners (NAIC) does not regulate life settlements directly, individual states have their own laws, often based on a model act, to protect the terminally ill and monitor the ratings of insurance companies.

Working With Life Settlement Brokers

When selling your insurance policy, you have the option to work directly or engage with a viatical settlement broker or life settlement broker, who essentially perform the same function but may have different buyers. It is crucial to understand that numerous intermediaries can become involved in the process.

Ideally, a life settlement or viatical settlement broker should prioritize the client’s interests due to their fiduciary responsibility. However, it is essential to exercise caution, as some brokers may not adhere to this requirement. To address these concerns, the viatical.org direct platform was introduced to the Life Insurance Settlement Association (LISA) in 2016.

Choosing the Best Viatical and Life Insurance Settlements Company

Choosing the best life settlement company can be challenging because different companies have preferences for specific types of policies. Some viatical settlement companies may only consider policies where the insured is projected to live less than two years, while others focus on policies with a projected life expectancy of 10 years or more. Each company operates with its own unique approach.

If you are unsure where to begin and are considering working with a life settlement broker or viatical broker, be aware that they may charge up to 30% or more of your settlement. However, the vibrant life settlement market also offers the opportunity to sell your policy directly to investors.

Selling a life insurance policy can be daunting, as many financial advisors possess limited knowledge of the process and certain state insurance regulators lack oversight. A good starting point is to get your policy appraised. The viatical.org platform can assist you in finding the best buyer for your policy, regardless of your health condition, whether you are sick, chronically ill, or in decent health.

What is a Viatical?

vi·at·i·cal, vīˈatikəl,/

(noun) – A financial transaction whereby a person with a terminal illness sells their life insurance policy to a third party for less than the face amount of the policy but more than the cash value in the policy.

Sell Your Life Insurance Policy For Cash, Now, While you are still living.

A viatical is a transaction where the owner of a life insurance policy who has less than 24 months or less to live sells his interest as the insured to a viatical settlement company. The viatical life settlement company makes a cash payment to the insured in exchange for ownership and beneficiary of the life insurance policy. When the insured dies, the viatical settlement company receives a return on its investment in the form of the proceeds from the life insurance policy.

Learn about the benefits of viatical and life insurance settlements and about your different options, including Medicaid Life Settlements, Retain a Portion Settlements, and life insurance loans. Have your policy appraised before you take the next step. Knowing what your policy could be worth as a life insurance settlement gives you an advantage with the next step of the life settlement process.

A viatical settlement is a financial transaction that allows individuals with a life-threatening illness to sell their life insurance policy for a lump sum of cash, providing them with much-needed funds during a difficult time. If you or a loved one are considering this option, understanding the process is crucial.

When you engage in a viatical settlement transaction, you transfer the ownership of your insurance policy to a viatical settlement purchaser. They become the beneficiary of the policy and pay you a lump sum that is a percentage of the policy’s face value. This arrangement grants you immediate access to funds that can be used to cover medical expenses, improve quality of life, or address other financial obligations.

What is an Example of a Viatical Settlement? Learn More About Life Settlements

In a viatical settlement, the policyholder, or viator, sells their life insurance policy to a viatical settlement purchaser for a lump sum of cash. For example, a 52 year old man with a terminal diagnosis and a 2 year life expectancy decides to sell his $200,000 Universal Life policy in a viatical settlement. He receives $140,000 in cash that can be used immediately.

The viatical settlement purchaser then assumes responsibility for paying the policy premiums and becomes the policy’s beneficiary. When the viator passes away, the viatical settlement purchaser receives the policy’s death benefit.

Who Gets Paid in a Viatical Settlement?

If you’re in poor health and considering selling your life insurance policy, also known as a viatical settlement, you might be wondering how and who exactly gets paid in this process. Viatical settlement companies specialize in purchasing life insurance policies from policyholders like you. By selling your policy, you can receive a lump sum payment that may be significantly higher than the policy’s surrender value.

You get paid immediately upon the sale of your life insurance policy and the buyer of your policy will continue to pay the policy premiums and ultimately gets paid when the insured on the life insurance policy passes away.

Do Your Homework

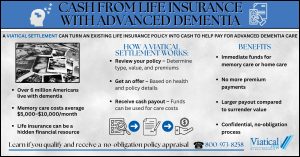

- Cash from Life Insurance with Advanced Dementia

Families caring for someone with advanced dementia face overwhelming challenges – emotionally, physically, and financially. Accessing cash from life insurance with advanced dementia is one option that can help relieve some of the financial burden. Through a viatical settlement, policyholders can sell an existing life insurance policy in exchange for a lump-sum cash payment. This payout can be used for critical needs, such as memory care, medications, or in-home support, at a time when expenses are often at their peak. The High Costs of Advanced Dementia Care The care needs of someone with …See More

Families caring for someone with advanced dementia face overwhelming challenges – emotionally, physically, and financially. Accessing cash from life insurance with advanced dementia is one option that can help relieve some of the financial burden. Through a viatical settlement, policyholders can sell an existing life insurance policy in exchange for a lump-sum cash payment. This payout can be used for critical needs, such as memory care, medications, or in-home support, at a time when expenses are often at their peak. The High Costs of Advanced Dementia Care The care needs of someone with …See More - How to Get a Life Insurance Policy Valuation If You’re Terminal

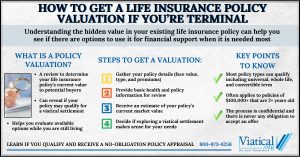

If you or a loved one has been diagnosed with a terminal illness, it is important to understand every financial option available. One of the most overlooked resources is your life insurance policy. You may be wondering how to get a life insurance policy valuation if you’re terminal. This process can help you discover whether your policy has immediate value that you can access now, when it is most needed. What Is a Life Insurance Policy Valuation? A life insurance policy valuation determines how much your policy is worth on the secondary market. …See More

If you or a loved one has been diagnosed with a terminal illness, it is important to understand every financial option available. One of the most overlooked resources is your life insurance policy. You may be wondering how to get a life insurance policy valuation if you’re terminal. This process can help you discover whether your policy has immediate value that you can access now, when it is most needed. What Is a Life Insurance Policy Valuation? A life insurance policy valuation determines how much your policy is worth on the secondary market. …See More - Can You Sell Your Life Insurance Policy After a Liver Cancer Diagnosis?

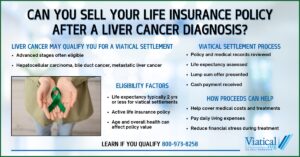

A liver cancer diagnosis can change many aspects of your life, including your financial situation. Health insurance doesn’t always cover all costs especially those associated with alternative therapies or daily living expenses. You may be wondering: Can you sell your life insurance policy after a liver cancer diagnosis? In many cases, the answer is yes and doing so through a viatical settlement may provide much needed financial relief during treatment. Understanding Viatical Settlements for Liver Cancer Viatical settlements allow policyholders with serious illnesses to sell their life insurance policies to a third party …See More

A liver cancer diagnosis can change many aspects of your life, including your financial situation. Health insurance doesn’t always cover all costs especially those associated with alternative therapies or daily living expenses. You may be wondering: Can you sell your life insurance policy after a liver cancer diagnosis? In many cases, the answer is yes and doing so through a viatical settlement may provide much needed financial relief during treatment. Understanding Viatical Settlements for Liver Cancer Viatical settlements allow policyholders with serious illnesses to sell their life insurance policies to a third party …See More - Why Cancer Patients Are Turning to Viatical Settlements

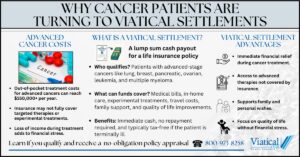

Why cancer patients are turning to viatical settlements has a lot to do with the overwhelming financial strain that comes with a cancer diagnosis. Cancer treatment is often expensive, and patients may face mounting medical bills, loss of income, and other financial challenges. A viatical settlement provides an option for cancer patients to sell their life insurance policy for a lump sum cash payment, offering much-needed financial relief during a difficult and uncertain time. Understanding Viatical Settlements for Cancer Patients A viatical settlement is a financial arrangement where an individual with a terminal …See More

Why cancer patients are turning to viatical settlements has a lot to do with the overwhelming financial strain that comes with a cancer diagnosis. Cancer treatment is often expensive, and patients may face mounting medical bills, loss of income, and other financial challenges. A viatical settlement provides an option for cancer patients to sell their life insurance policy for a lump sum cash payment, offering much-needed financial relief during a difficult and uncertain time. Understanding Viatical Settlements for Cancer Patients A viatical settlement is a financial arrangement where an individual with a terminal …See More - Who Qualifies for a Viatical Settlement in 2025?

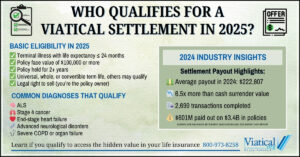

If you’ve been diagnosed with a terminal illness and have an active life insurance policy, you may be wondering: Who qualifies for a viatical settlement in 2025? This option, which allows individuals to sell their life insurance policy to a viatical settlement buyer for a lump-sum cash payment, continues to provide a critical financial lifeline for those facing high medical costs or needing to stabilize their finances during a difficult time. Viatical settlements are not new, but recent industry data shows that more people are turning to this option—and receiving significant payouts. Updated …See More

If you’ve been diagnosed with a terminal illness and have an active life insurance policy, you may be wondering: Who qualifies for a viatical settlement in 2025? This option, which allows individuals to sell their life insurance policy to a viatical settlement buyer for a lump-sum cash payment, continues to provide a critical financial lifeline for those facing high medical costs or needing to stabilize their finances during a difficult time. Viatical settlements are not new, but recent industry data shows that more people are turning to this option—and receiving significant payouts. Updated …See More